Capital raised by Israeli venture capital in 2005 was primarily the result of six new Israeli venture capital funds that completed their fund raising in the course of 2005. These were Benchmark Israel II that closed a $250 million fund, Carmel that closed its $200 million second fund and Israel Healthcare Ventures that closed on a $140 million second fund dedicated to the life sciences. Sequoia Israel and Genesis both closed third funds of $200 million and $160 million, respectively, while Giza closed its fourth fund after adding $30 million to the $120 million raised in 2004.

In addition, first closings were carried out by four Israeli venture capital funds, including Vertex Israel III which closed $120 million and the life science-focused Medica-Poalim, which closed on $80 million in 20005.

Several firms, including Concord, Israel Seed and Tamar Ventures suspended their plans to raise new funds in 2005.

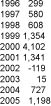

Capital Raised by Israeli VCs 1996-2005

During the past 18 month foreign pension funds increased their involvement in the Israeli VC market. These included CalSTRS - California State Teachers' Retirement System , CalPERS, NY State Retirement System ,Oregon Public Employees Retirement Fund, Pennsylvania State Employees Retirement System and TIAA-CREF, and others.

Zeev Holtzman, said, "2005 capital raising set a four-year record, confirming the pullout from the year 2000 crises. Investments came mostly from foreign sources, while local investors were generally on the sidelines. Local inactivity raises concern that Israeli institutions will miss out on the new wave of promising investment opportunities."

$2.3 billion available for investments

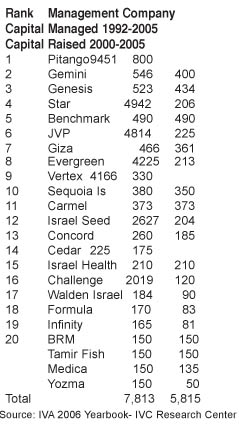

Top funds capital raising 1992-2005

The largest Israeli funds shown in the table below - ranked according to capital raised between 1992 and 2005 - accounted for $5.8 billion of the latter amount.

$200m invested in Israeli life sciences in 2005

Capital investment in Israeli life sciences companies totaled $200 million in 2005, according to PricewaterhouseCoopers, Israel - Kesselman & Kesselman's Money Tree survey on the life sciences. The survey was released ahead of the Biomed Israel 2006 exhibition in May.

Investment in Israeli life sciences in 2005 was less than the $285 million invested in 2004, but reflected the multi-year average of $50 million per quarter. The Money Tree survey for Israel was conducted at the same time as surveys in the US and Europe. 70 Israeli venture capital funds participated.

The survey also indicates that 70% of capital invested in the life sciences in 2005 was channeled to medical devices and equipment companies, the same proportion as in previous years. In contrast, the bulk of venture capital investment in the life sciences in the US was channeled to biotechnology. The survey showed that, in contrast to the US, where most investment was in later stage companies, most investment in Israel went to fairly early stage companies.

PricewaterhouseCoopers, Israel - Kesselman & Kesselman audit partner in charge of life sciences Claudio Yarza said no significant changes were predicted for 2006. He said, however, that the option of raising capital on the Tel Aviv Stock Exchange (TASE), in the event that this window of opportunity remains open, could provide the life sciences industry with an additional source of financing, which was essential for its further development.

In 2005, the favorable capital raising trend begun in 2004 intensified. Israeli venture capital funds raised $1.2 billion, an increase of 40 percent from the $724 million raised in 2004.

In 2005, the favorable capital raising trend begun in 2004 intensified. Israeli venture capital funds raised $1.2 billion, an increase of 40 percent from the $724 million raised in 2004.

According to IVC estimates, $2.3 billion in capital is currently available for investment by Israeli VCs, of which $1.4 million is intended for First investments in high-tech companies. The remainder is reserved for Follow-on investments. An additional $1 billion is expected to be raised in 2006 by Israeli VCs for investment in Israeli high technology.

Between 1992 and 2005, Israeli venture capital funds raised approximately $10.3 billion that was exclusively allocated to investments in Israeli technology companies. Of this amount, approximately $6.8 billion (66 percent) was raised between 2000 and 2005.

70% of capital invested in the life sciences in 2005 was channeled to medical devices and equipment companies.