Agis Industries (1983) Ltd. is Israel's second largest pharmaceutical

company. It is strategically positioning itself to move from being a

local diversified pharmaceutical and consumer products enterprise

into a specialized global pharmaceutical company.

The company has focused for several years on an effort to consolidate

and expand its activities overseas, through the sale of

pharmaceuticals in the US by an American subsidiary, and the sale of

APIs to the global generic pharmaceuticals industry, mainly in the

US. Agis (AGIS:TASE) since 1992, is a public company, listed on the

Tel-Aviv Stock Exchange. The company, while well known to the Israeli

public, is nearly unknown to international investors.

Company Description

Agis employs . 1,900 workers, of which . 600 are in the U.S.

Sales Analysis

Sales Breakdown in 2001 by Market Segment

Recent Share Price Development

Key Ratios

Summary

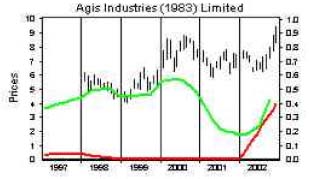

Its shares have recently been upgraded to the Tel-Aviv 100 providing

greater investor visibility and liquidity.

We believe that Agis shares provide an interesting vehicle for

investors to participate, at a reasonable valuation, in Israel's

growing generic industry. The shares are yielding 4.2% having

recently distributed $0.43 a share dividend. All of these factors add

to Agis' investment attractiveness.

The Agis Group's principal activities are manufacturing, marketing

and importing of pharmaceuticals; developing and manufacturing of

active pharmaceuticals ingredients (API); importing and marketing of

medical equipment, paramedical products, and medical diagnostic

products; manufacturing and marketing of drugs, cosmetics, toiletries

and consumer goods; and manufacturing of bar soap, cleaning products,

detergents, powdered laundry detergents, toiletries and baby

products. It operates four manufacturing facilities in Israel and one

in the USA. It sells its products mainly in Israel and the USA. Drug

sales accounted for 66% of 2001 revenues; consumer products 28% and

medical applications 6%.

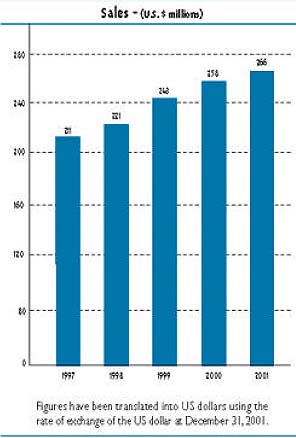

During the year ended December of 2001, sales at Agis Industries

(1983) Limited were US$251.8 million, This was the fifth consecutive

year of sales increases at Agis since 1996, sales have increased by

71%.

Pharmaceuticals Sold in Israel 30%

Generic Pharmaceuticals in U.S.A 25%

Active Pharmaceutical Ingredients (API) 12%

Diagnostics and Medical Equipment 6%

Consumer Products 27%

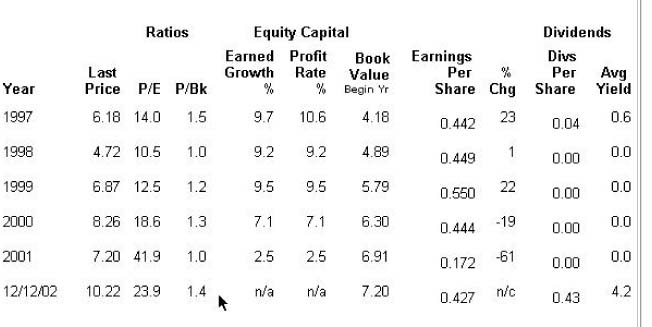

The share price was up 37.9% to $10.22 over the past 13 weeks. . In

the 12 months ending 9/30/02, earnings totaled $0.43 per share. The

share have recently traded at a Price / Earnings ratio of 24. These

12 month earnings are substantially greater than the earnings per

share achieved during the calendar year ending last December, when

the company reported earnings of 0.17 per share. Earnings per share

fell 61.4% in 2001 from 2000.

The share price was up 37.9% to $10.22 over the past 13 weeks. . In

the 12 months ending 9/30/02, earnings totaled $0.43 per share. The

share have recently traded at a Price / Earnings ratio of 24. These

12 month earnings are substantially greater than the earnings per

share achieved during the calendar year ending last December, when

the company reported earnings of 0.17 per share. Earnings per share

fell 61.4% in 2001 from 2000.

The shares are currently trading at 1.12 times sales and at 1.41

times book value.

Agis' strategy is clearly aimed at increasing its overseas sales. It

has shown its ability to sell the American market and here is where

we anticipate major growth in 2003.